News about Scalable Capital

De nieuwe ETF is de eerste in zijn soort. Het maakt gebruik van intelligente indexering en hybride replicatie om een optimale structuur te realiseren die alle landen en regio's wereldwijd met maximale efficiëntie dekt.

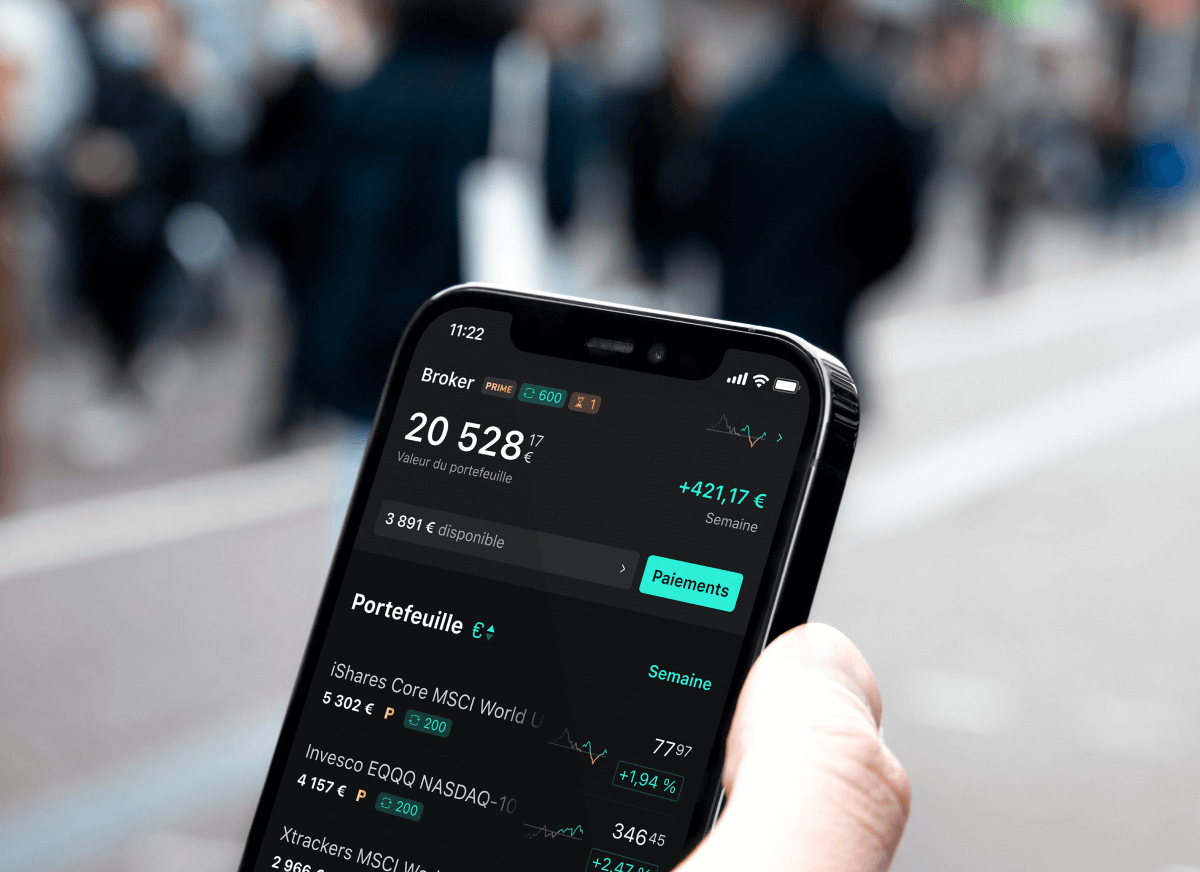

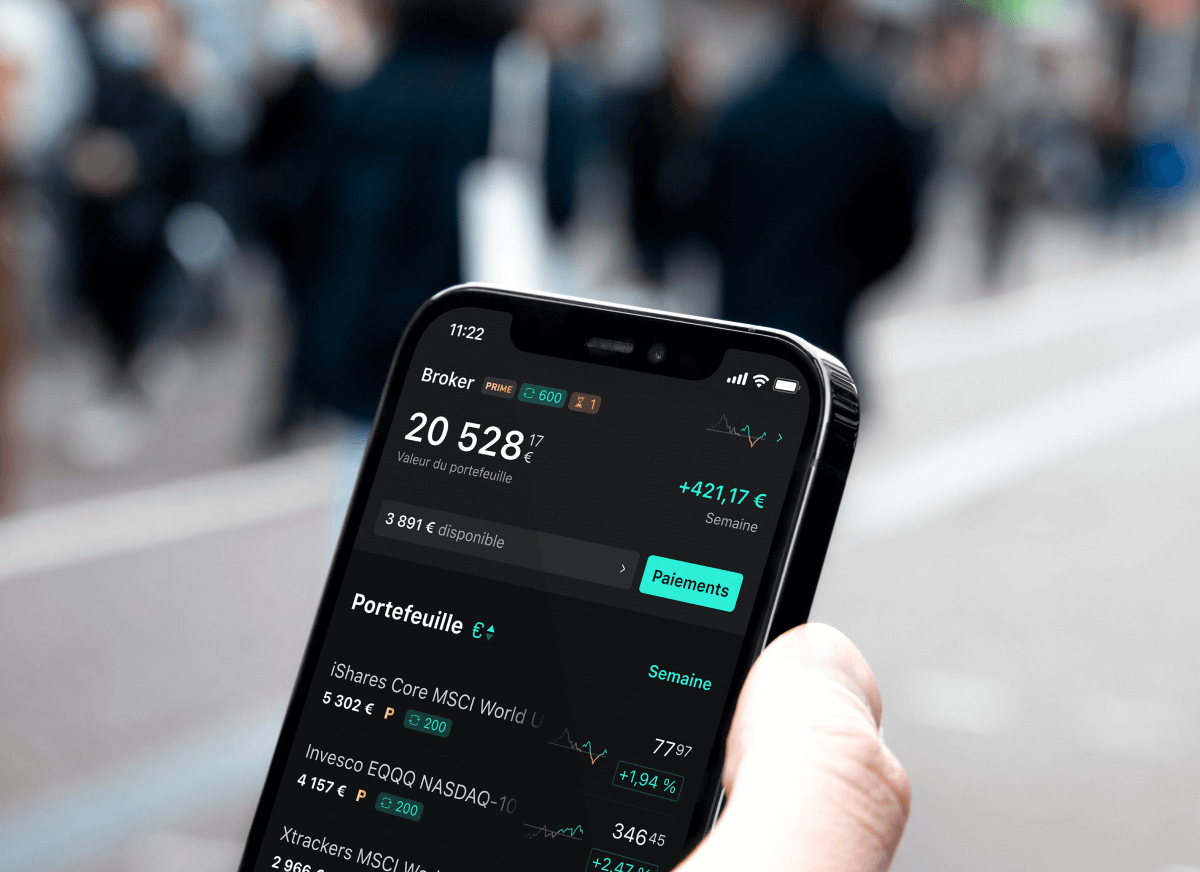

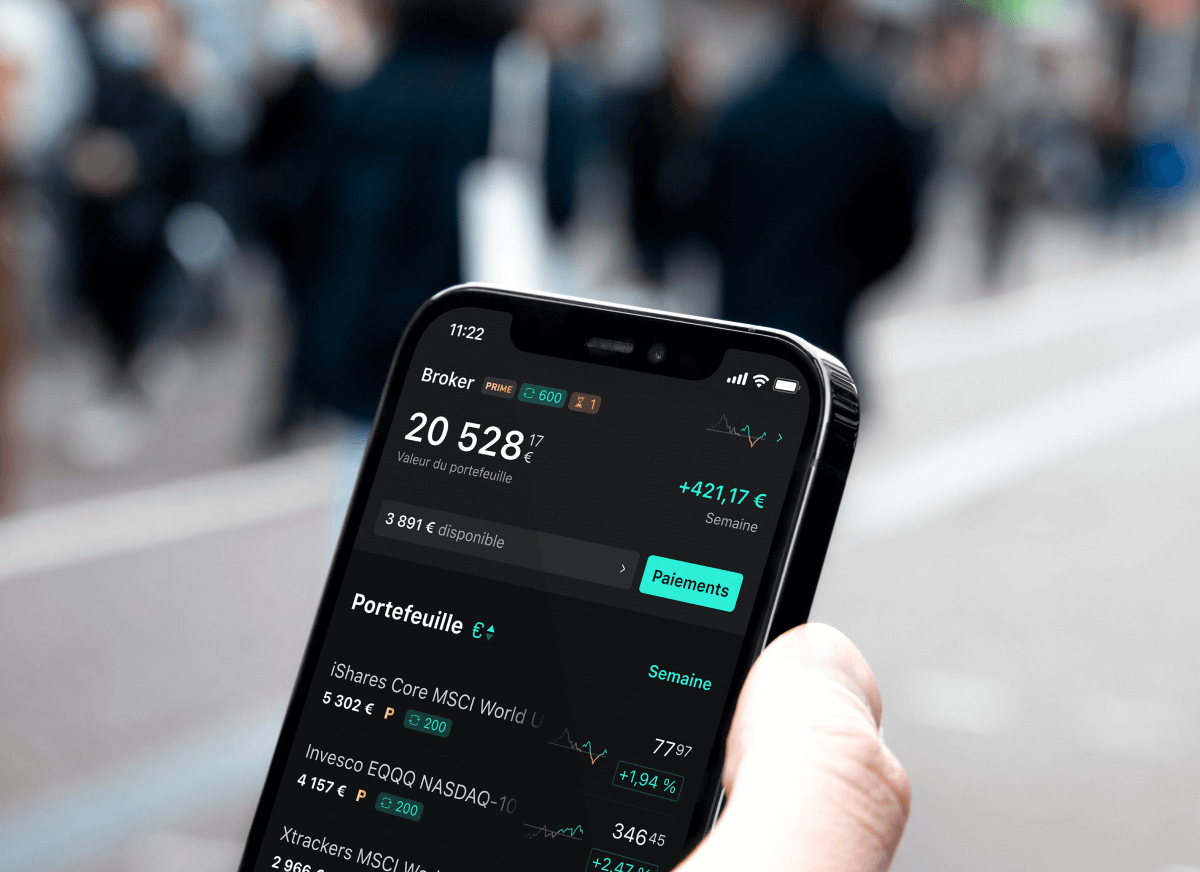

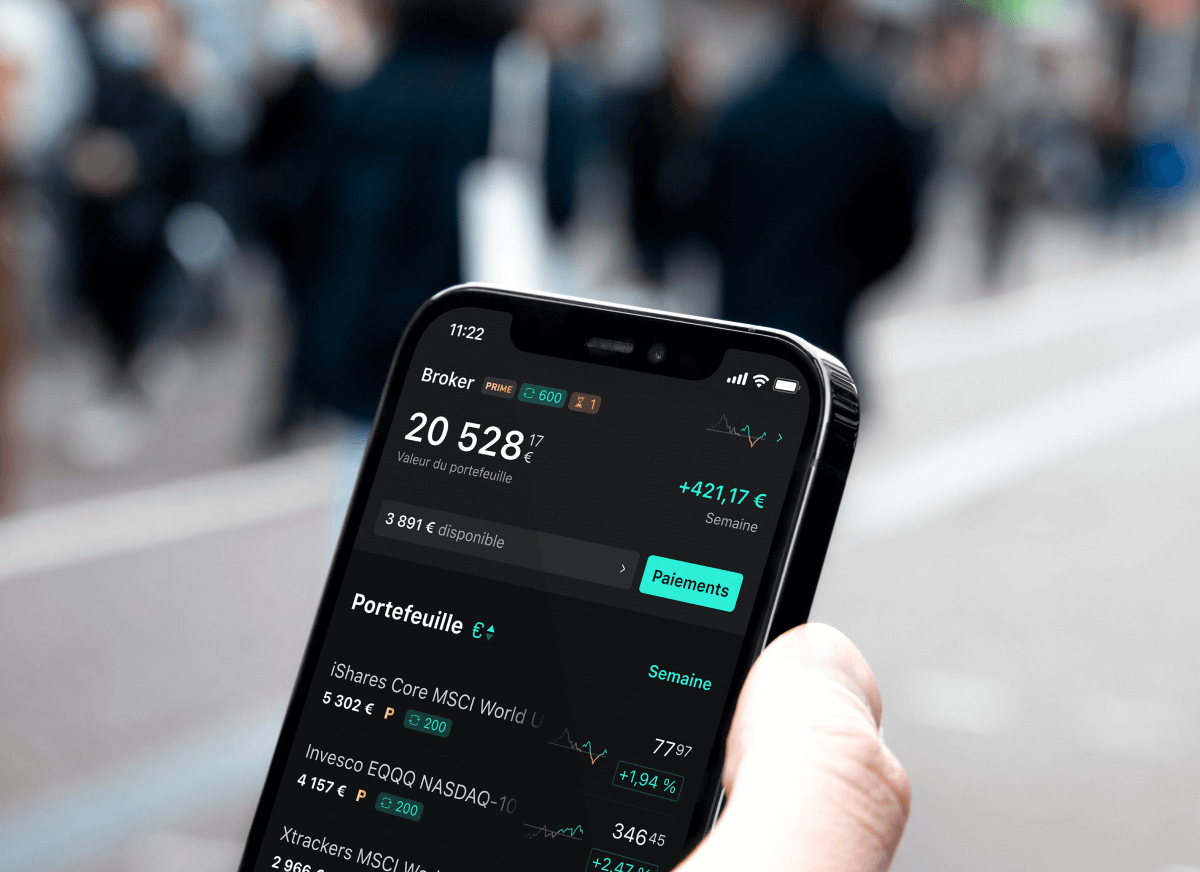

Scalable Capital, met een beheerd vermogen van meer dan 20 miljard euro afkomstig van meer dan 1 miljoen klanten in Europa, zet met de ontwikkeling van haar nieuwe technologieplatform een nieuwe standaard voor particuliere beleggingen.

De Europese online broker Scalable Capital heeft 60 miljoen euro opgehaald aan equity-financiering. Dit brengt de totale financiering van het bedrijf op 326 miljoen euro. Het bedrijf wil het nieuwe kapitaal gebruiken om verdere groei te realiseren.

The digital wealth manager is seeing “record demand” from investors for its ETF and stock savings plans.

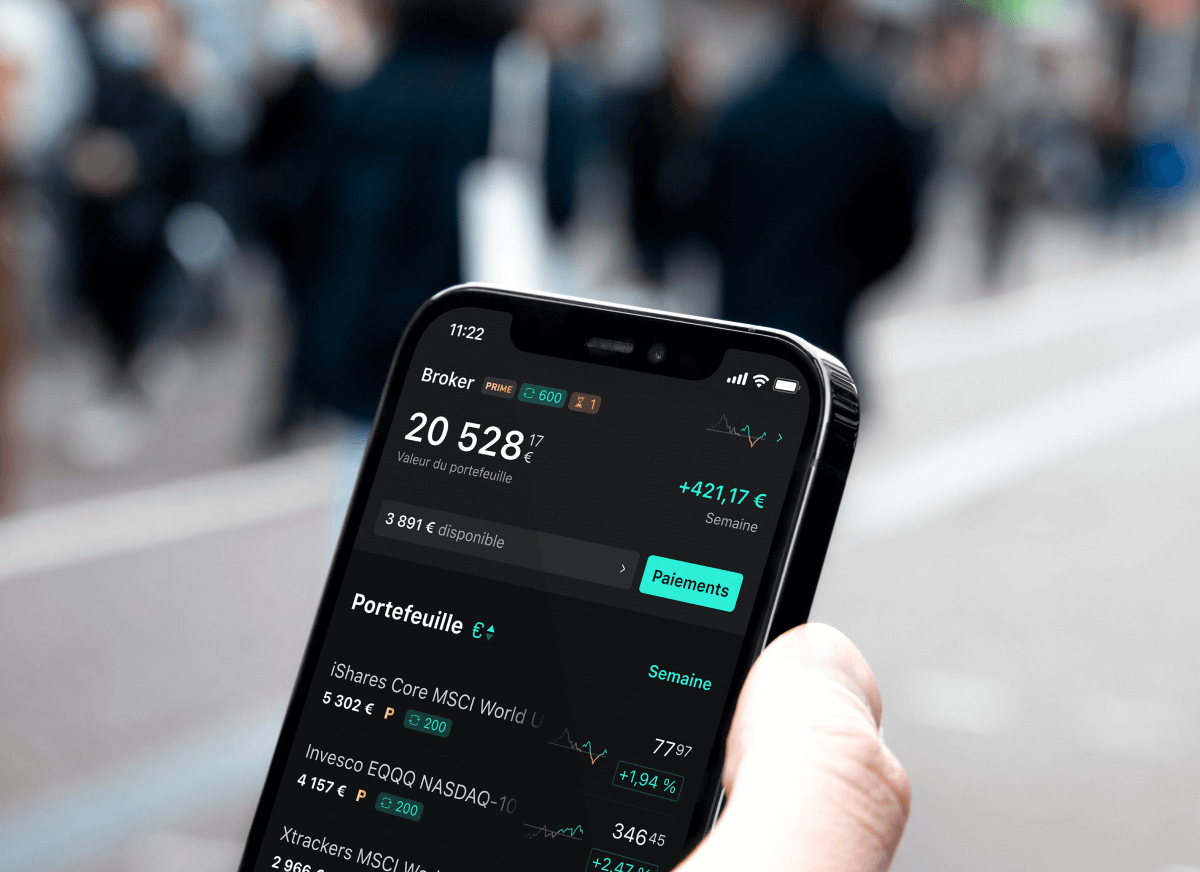

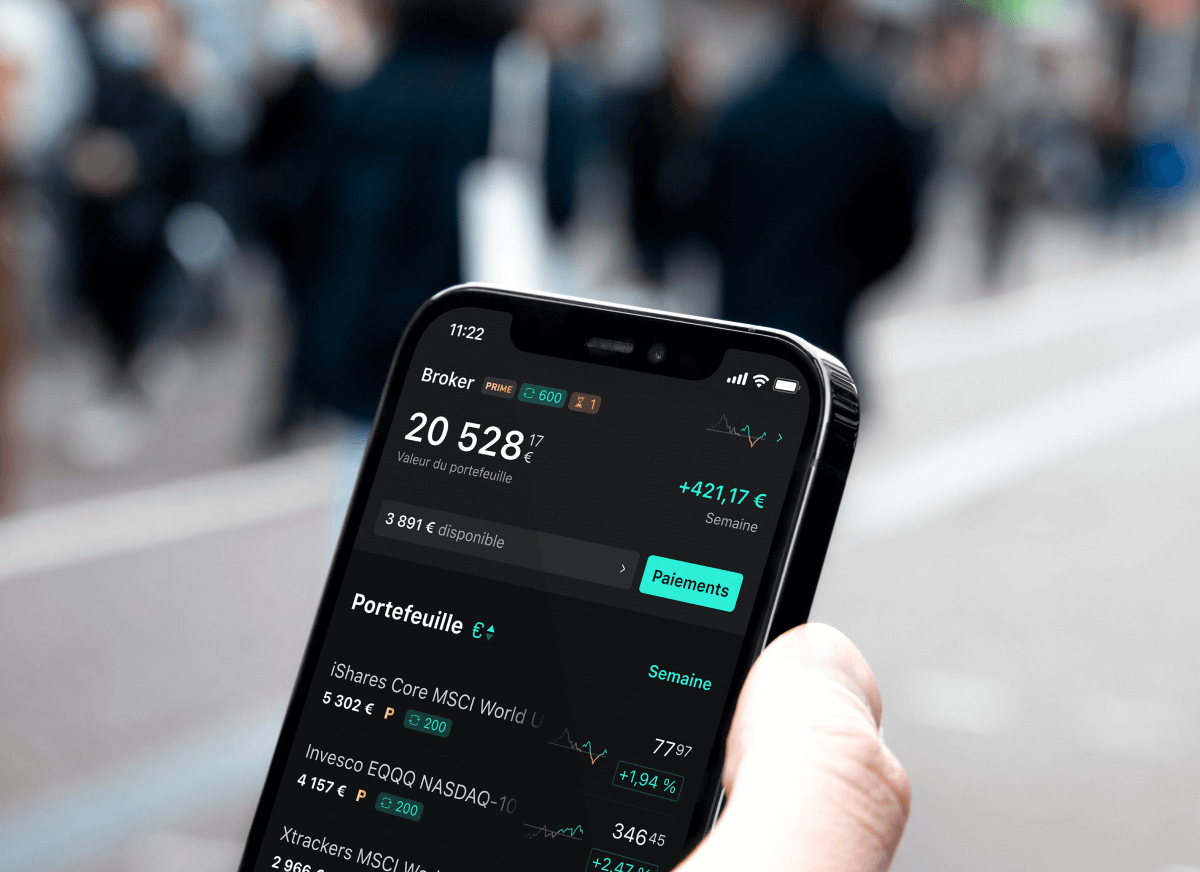

Scalable is een digitaal beleggingsplatform dat op het gebied van vermogensbeheer in Duitsland samenwerkt met ING. Scalable heeft na een verdubbeling in een jaar tijd nu meer dan €10 mrd van klanten onder beheer. 'Als broker zijn we een soort vakbond voor particuliere beleggers om een betere prijs te krijgen van market makers', zegt Erik Podzuweit, oprichter van Scalable Capital.

Exchange traded funds, centre stage in a price war that has sharply reduced the cost of investment vehicles, appear to be playing a leading role in another revolution that is slashing the cost of investing — the proliferation of low or no-fee online platforms and apps.

Three developments have led to the rise of wealthtech. First, looking on the demand side, there is the notion of fluid expectations. Clients expect the same convenient just in time digital experience in their financial services as in e-commerce for instance. Intuitive interfaces and instant interaction especially appeal to the newly arised generation of retail investors. RankiaPro Europe

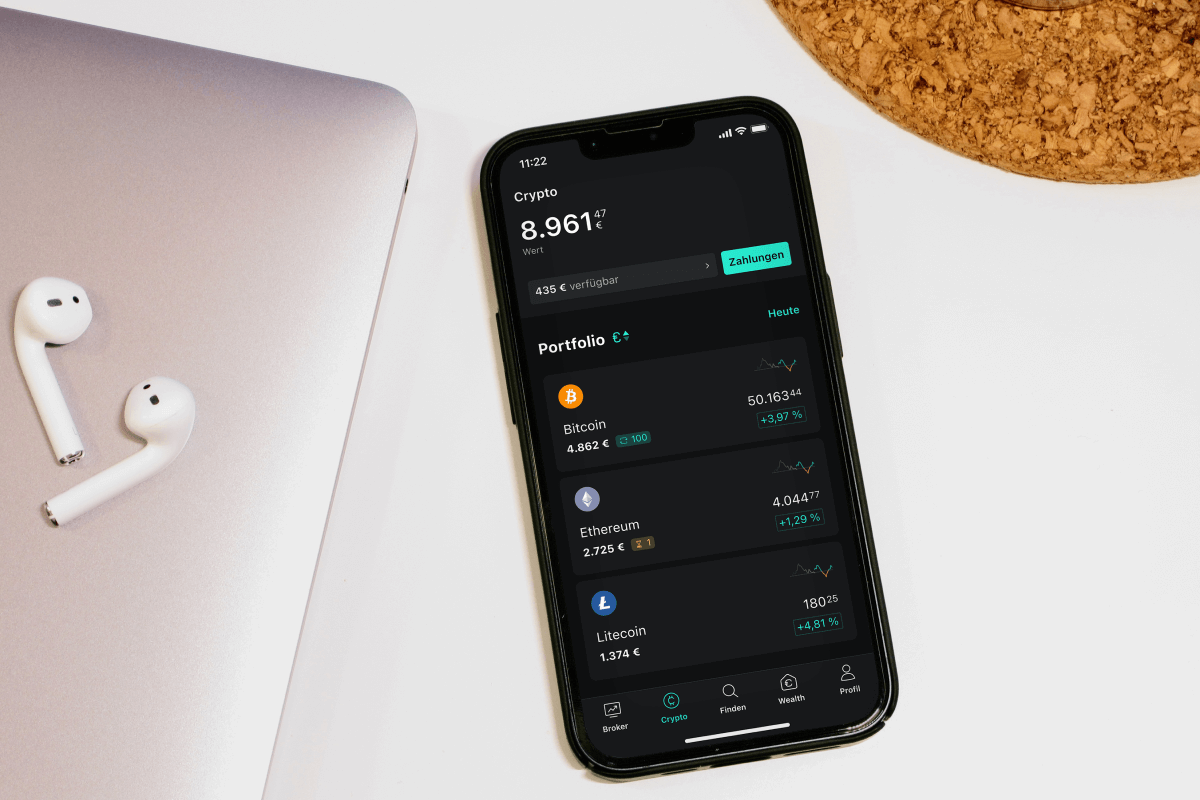

Scalable Capital has become the latest neo-broker to push into cryptocurrency trading with the launch of its new product "Scalable Crypto," according to an announcement.

Germany’s digital wealth manager Scalable Capital is enjoying a boom in stock market investing in the country, driven in part by their ETF-based offering.

Scalable Capital, a German financial technology firm founded by former Goldman Sachs Group Inc. bankers and backed by BlackRock Inc., will roll out its broker app to some of Europe’s biggest non-German-speaking countries.

Horde of competing apps are betting on the "Americanisation" of European share trading after memestock frenzy.

All savings plans for stocks, ETFs and cryptocurrencies are now free of order fees as competition in the digital wealth market heats up.

Neobrokers — startups that are disrupting the investment industry by providing a platform for a wider range of consumers to partake in the stock market by offering them more incremental investment options and modern and easy mobile-based interfaces to manage their money — continue to see a huge amount of interest, and today comes the latest development in that story.

Online brokerage Scalable Capital said on Tuesday it had raised 150 million euros ($183 million) from investors led by China's Tencent (0700.HK), becoming the latest German fintech to attract sizable funding.

Negative bank rates and booming U.S. stocks like Amazon, Tesla—even GameStop—embolden investors

Scalable Capital — the Munich-based startup that has built a platform to monitor and manage investment portfolios investing in shares, manage trades and exchange traded funds for a flat fee of €2.99 per month — has closed a round of €50 million ($58 million) to expand its business.

The Economist berichtet über unsere erfolgreiche Kooperation mit ING-DiBa. In den ersten zwei Monaten der Kooperation haben bereits knapp 7.000 ING-DiBa-Kunden über 150 Millionen Euro angelegt.

Scalable Capital has been granted authorisation by the ECB to conduct deposit and lending business. This makes Scalable Capital a CRR credit institution (full bank) supervised by the German Federal Financial Supervisory Authority (BaFin) and the Deutsche Bundesbank.

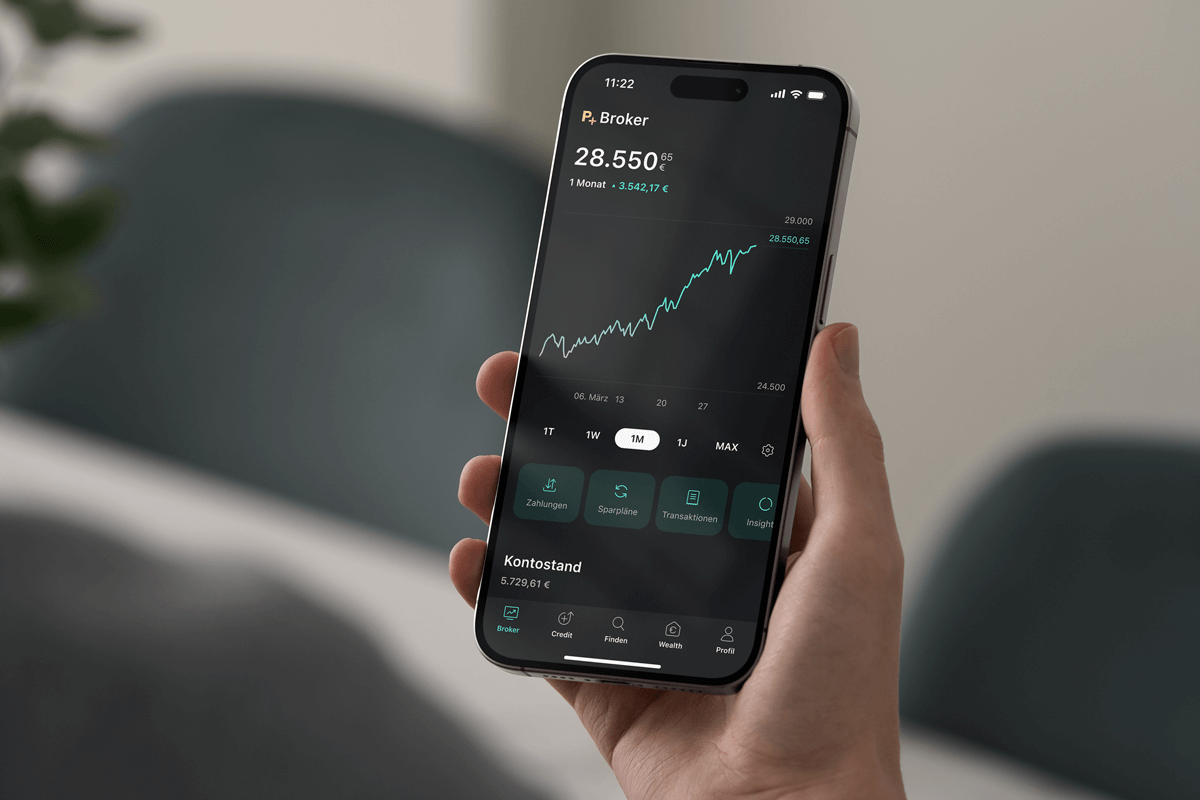

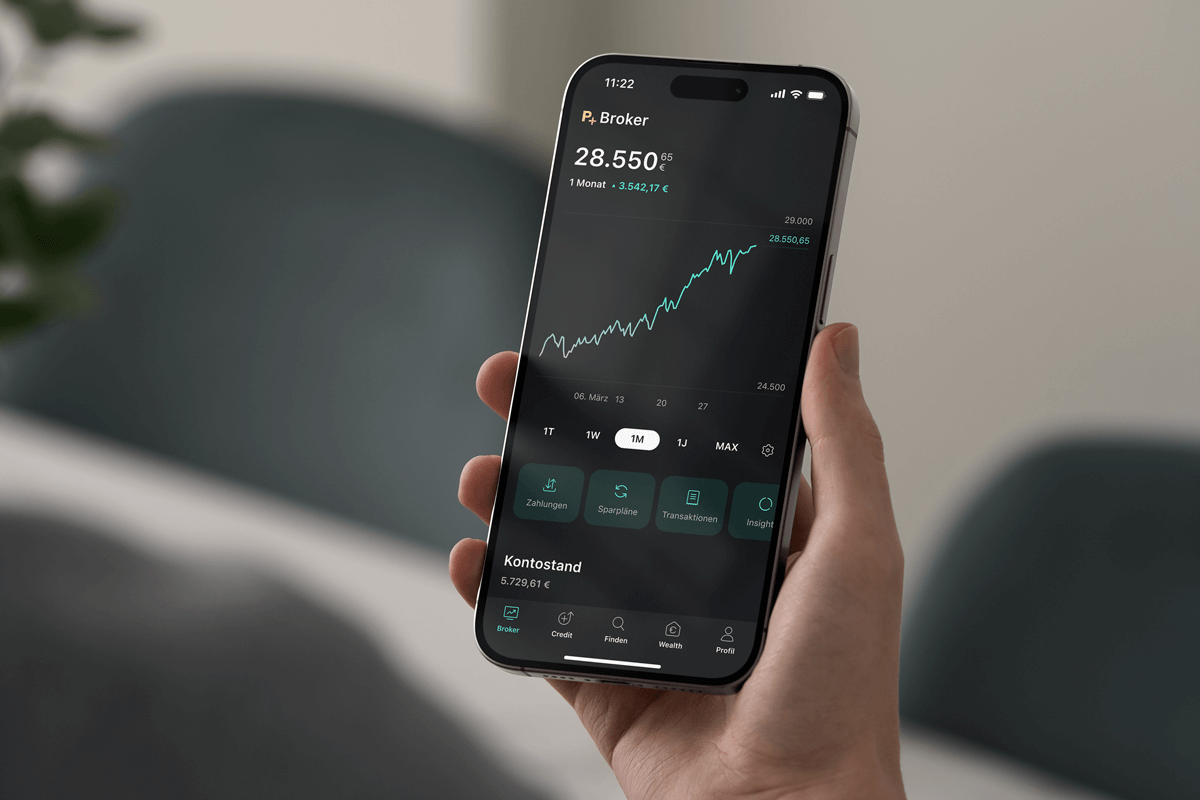

Scalable Capital is revolutionising how private investors access financial knowledge with the launch of "Insights". This innovative feature integrates specially adapted artificial intelligence directly into the platform's user interface, making Scalable Capital the first European broker to embed generative AI for real-time responses to financial and investment queries.

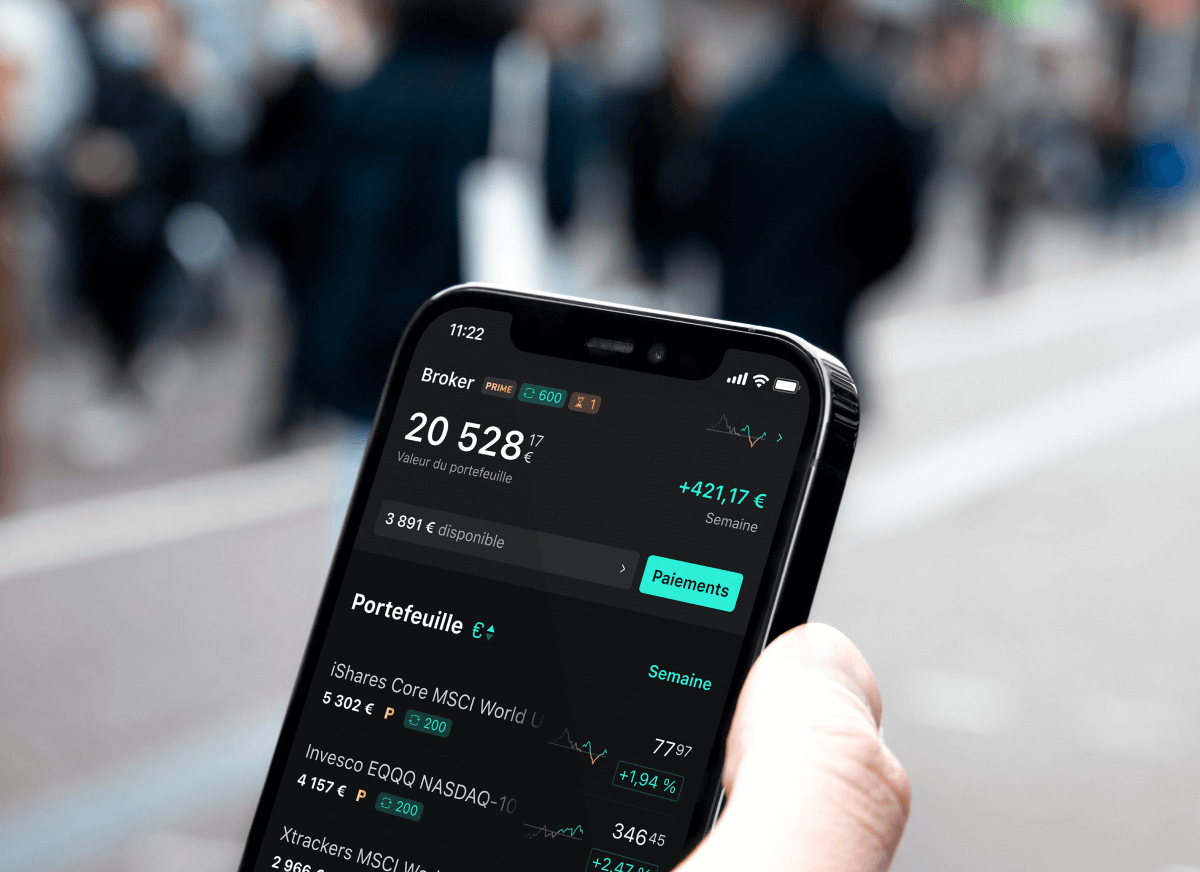

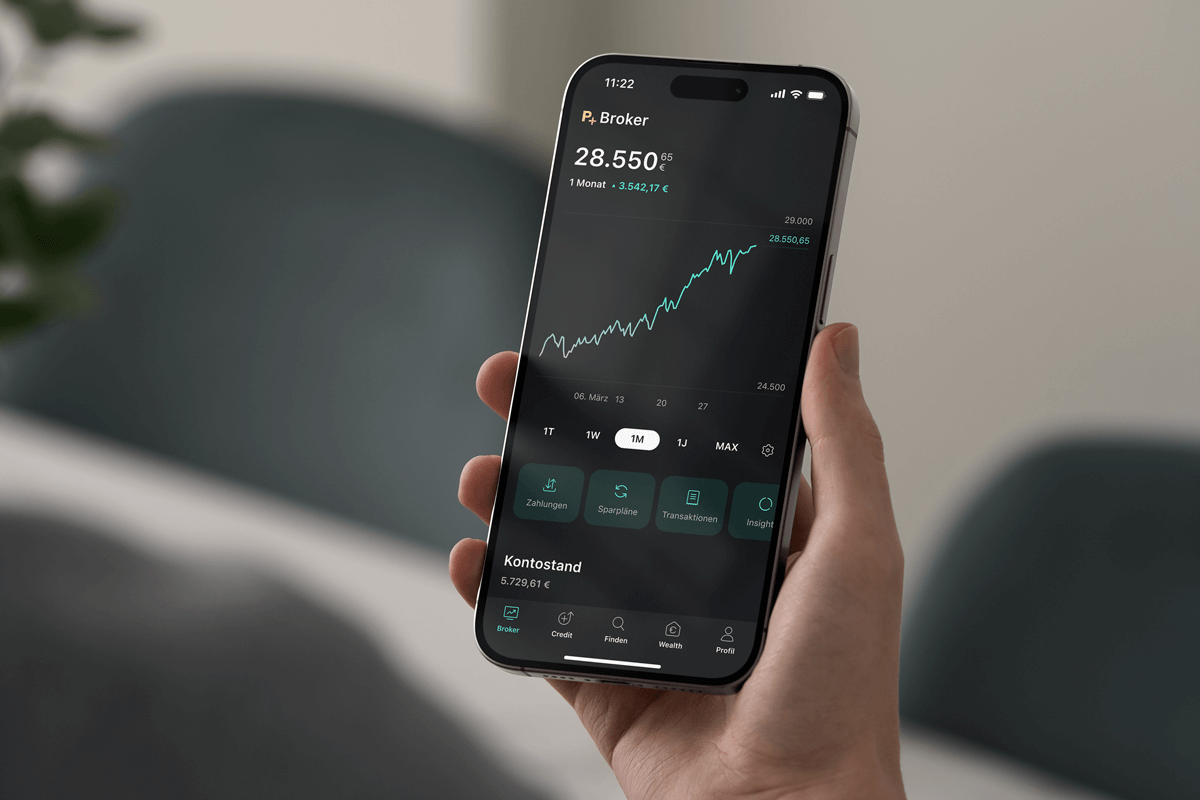

Scalable Capital, met een beheerd vermogen van meer dan 20 miljard euro afkomstig van meer dan 1 miljoen klanten in Europa, zet met de ontwikkeling van haar nieuwe technologieplatform een nieuwe standaard voor particuliere beleggingen. Vanaf vandaag kunnen beleggers direct een beleggingsrekening openen bij Scalable Capital, waarbij ze profiteren van verbeterde handelsvoorwaarden en directe toegang tot een nieuwe aandelenbeurs.

Scalable Capital, een toonaangevend digitaal investeringsplatform in Europa, kondigt vandaag de afsluiting van een financieringsronde van 60 miljoen euro aan. De financieringsronde is geleid door het Europese venture capital fonds Balderton Capital met deelname van het nieuwe groeifonds van HV Capital en bestaande investeerders.

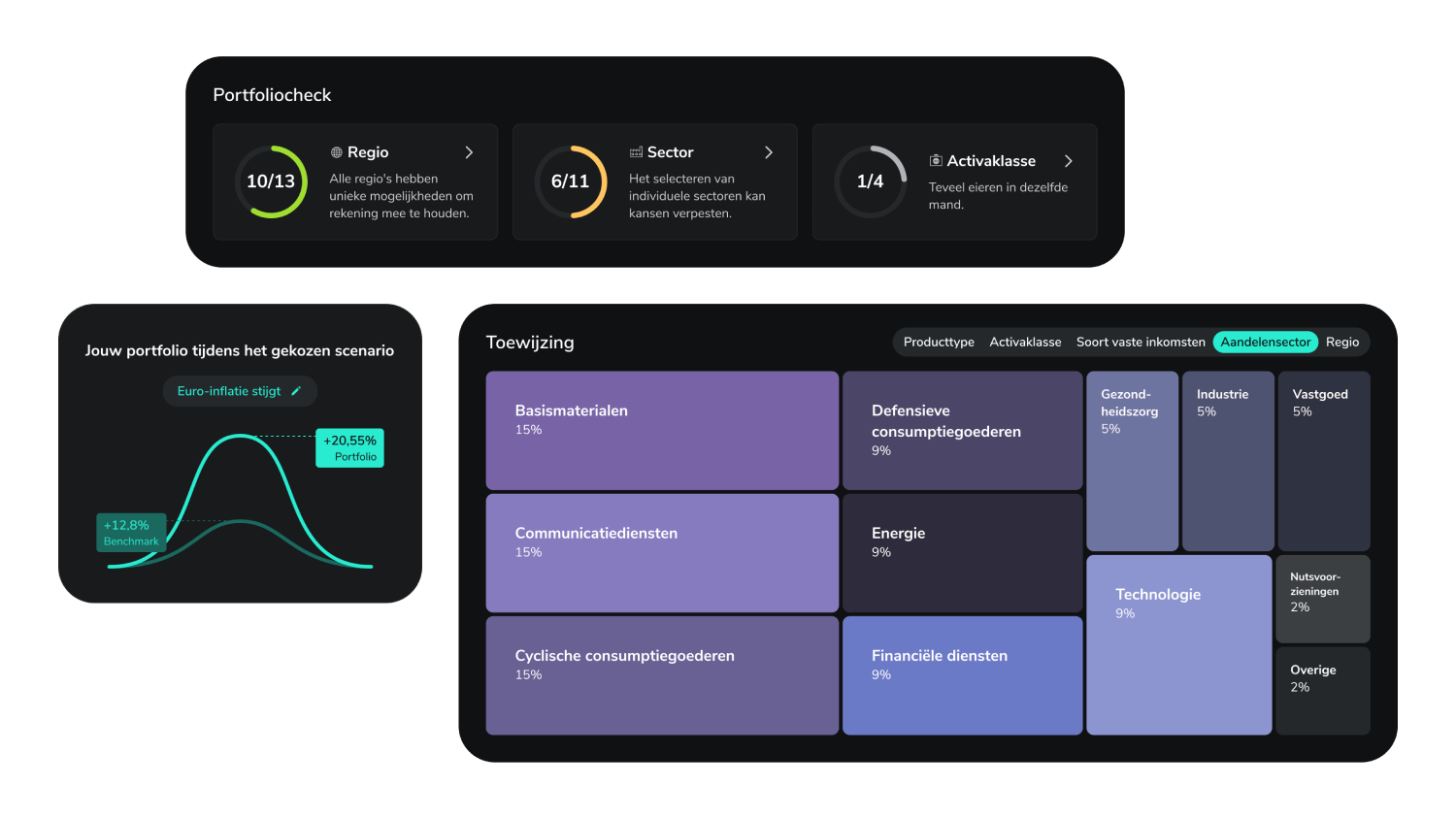

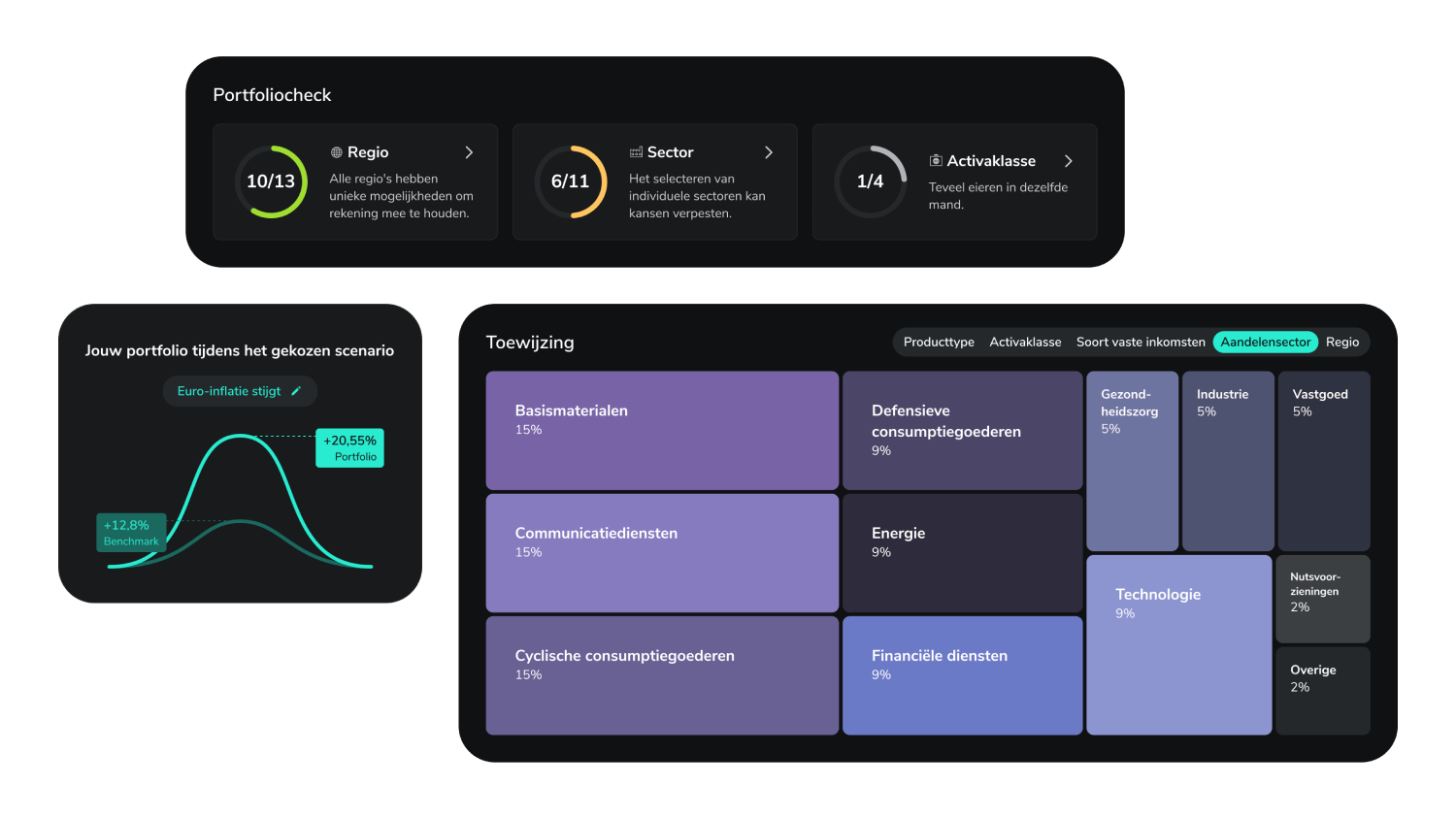

Scalable Capital, een toonaangevend beleggingsplatform, breidt zijn platform op 24 oktober uit met de portfolioanalysetool Insights. Dat geeft Scalable-klanten talloze inzichten over hun effectenportfolio, zoals de gevolgen van inflatie en eventuele verborgen risico’s. Met Insights krijgen gebruikers van Scalable Broker een range aan analysemogelijkheden die eerder was voorbehouden aan professionele beleggers. Particuliere beleggers krijgen voor de eerste keer toegang tot de financiële technologie van BlackRock, de toonaangevende leverancier van beleggingsoplossingen en risicobeheertechnologie. Beleggers kunnen zo concentratierisico's in de portefeuille detecteren en leren hoe ze die kunnen verminderen door gerichte diversificatie. De scenariosimulaties illustreren hoe de portefeuille zou presteren bij bijvoorbeeld een stijgende rente, hoge inflatie of een aandelencrash.

Klanten van Scalable Capital, een toonaangevend beleggingsplatform in Europa, ontvangen vanaf 3 augustus 2023 2,6 % rente per jaar op hun tegoed tot 100.000 euro. Dit is het hoogste rentetarief van alle brokers in de markt. Het aanbod geldt zowel voor bestaande als nieuwe klanten van de PRIME+ broker. De variabele rente, die tot nader order geldt, wordt per kwartaal uitgekeerd via partnerbank Baader Bank aan bestaande en nieuwe tegoeden van de verrekeningsrekening.

Scalable Capital, een toonaangevend beleggingsplatform in Europa, betaalt 2,3 procent rente op kassaldi om beleggers te laten profiteren van de positieve rentetrend. Het aanbod start op 1 februari en geldt voor zowel nieuwe als bestaande klanten van PRIME+ in heel Europa. Het prijsmodel PRIME+ combineert een marktleidend aanbod van depositorente met de meest betaalbare en beste broker-service voor aandelen en ETF's.

Scalable Capital, een toonaangevend investeringsplatform in Europa, heeft de grens van één miljoen beleggingsplannen overschreden. Deze mijlpaal toont aan hoe populair de commissievrije beleggingsplannen van Scalable Capital zijn en benadrukt hun belang voor pensioenvoorzieningen op lange termijn.

Scalable Capital, een toonaangevend digitaal investeringsplatform in Europa, breidt uit naar Nederland. Met de Scalable Broker en Scalable Crypto introduceert het bedrijf handige en kosteneffectieve handels- en spaarplannen in exchange-traded funds (ETF's), beleggingsfondsen, aandelen en cryptovaluta voor Nederlandse particuliere beleggers. Gereguleerd door de Duitse financiële toezichthoudende autoriteit BaFin, biedt Scalable Capital een veilig en innovatief full-service brokerage-aanbod.

Scalable Capital has been granted authorisation by the ECB to conduct deposit and lending business. This makes Scalable Capital a CRR credit institution (full bank) supervised by the German Federal Financial Supervisory Authority (BaFin) and the Deutsche Bundesbank.

Scalable Capital is revolutionising how private investors access financial knowledge with the launch of "Insights". This innovative feature integrates specially adapted artificial intelligence directly into the platform's user interface, making Scalable Capital the first European broker to embed generative AI for real-time responses to financial and investment queries.

Scalable Capital has successfully completed a funding round, raising €155 million ($175 million). This is the company’s largest funding round to date and is led by Sofina and Noteus Partners. Existing investors Balderton Capital, Tencent, and HV Capital also participated, underlining their continued confidence in the company.

Clients at Scalable Capital can invest in Swiss stocks from Friday, May 2, 2025. Trading takes place via the European Investor Exchange and gettex as well as Xetra. After more than five years of suspension, Swiss stocks will be tradable on EU stock exchanges again.

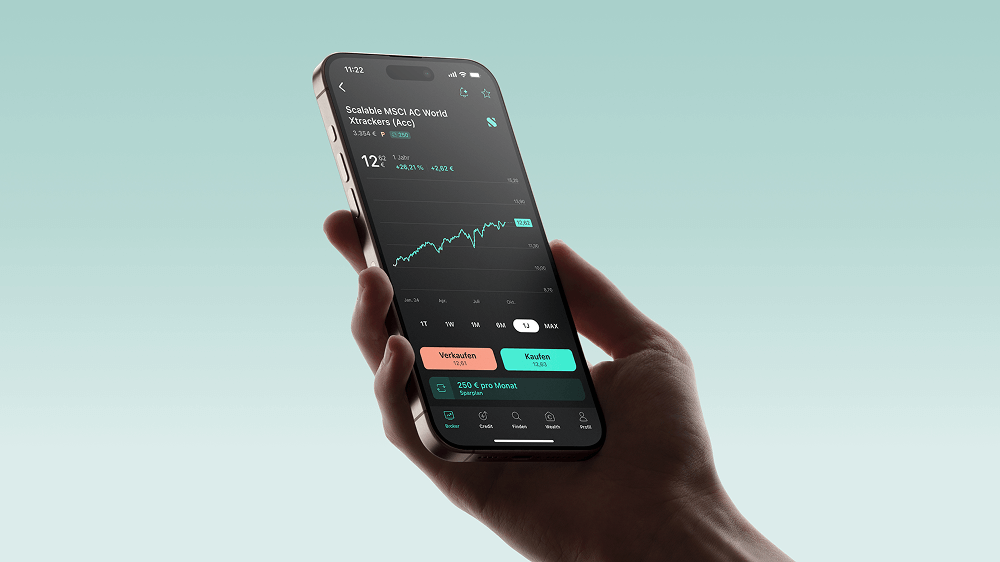

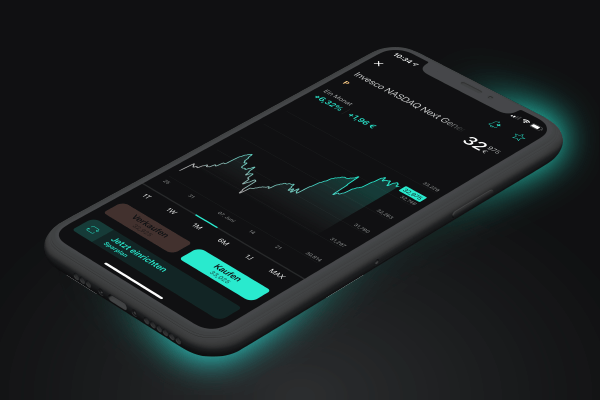

Scalable Capital, a leading digital investment platform in Europe, launched their own World ETF, the Scalable MSCI AC World Xtrackers UCITS ETF (ISIN: LU2903252349), on December 20, 2024. Since then, the ETF has already surpassed 100 million euro in fund volume.

As the first digital investment platform in Germany Scalable Capital launches its own global equities core ETF, the “Scalable MSCI AC World Xtrackers UCITS ETF” (WKN: DBX1SC). Scalable Capital advises the asset manager DWS on the construction and replication of the portfolio for the new ETF.

Scalable Capital, a leading digital investment platform in Europe, announced the closing of a 60 million euro equity financing. This extension of the series E round was led by European venture capital firm Balderton Capital.

How does my portfolio cope with rising inflation? Which regions are missing? Does my portfolio face any hidden risks? - The answers to these and many other questions can be provided with “Insights”, the new portfolio analytics tool in the Scalable Broker.

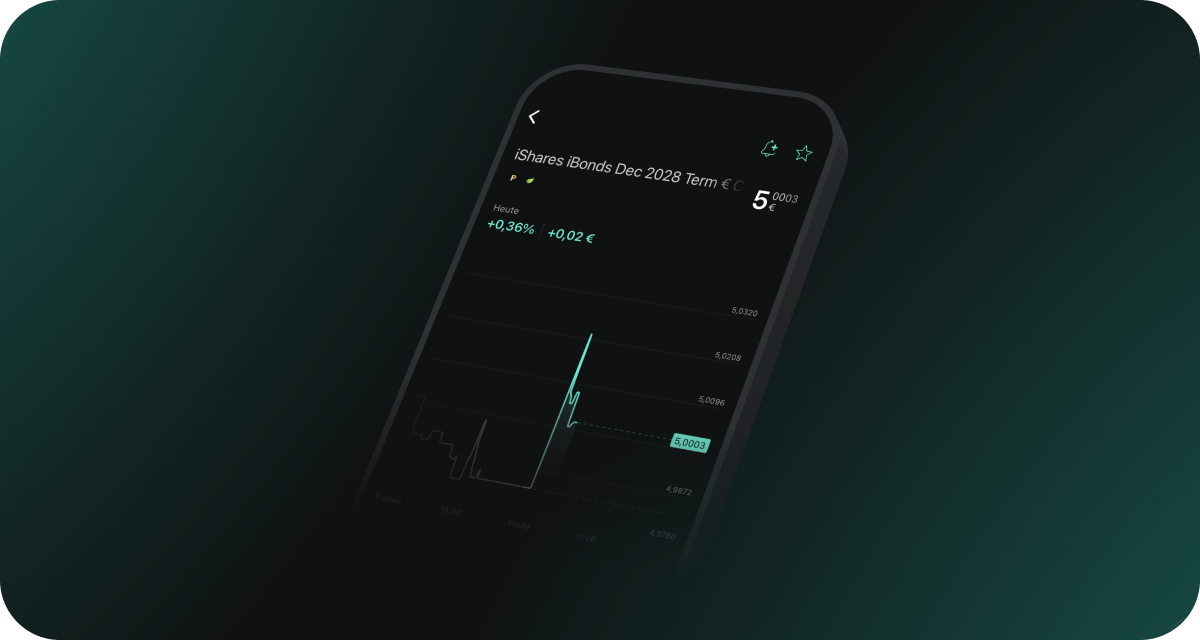

Clients of Scalable Capital, a leading investment platform in Europe, can now invest in a new form of bond ETFs. As a full service broker, Scalable Capital provides retail investors with valuable investment solutions and continues to expand its range of fixed income products. With iShares iBonds, clients are given access to a suite of products that combine the diversification, liquidity and tradability of an ETF with the fixed maturity of a bond. The issuer, BlackRock, one of the world’s leading providers of investment, advisory and risk management solutions, is rolling out iBonds in Europe for the first time. They consist of a diversified set of bonds with similar maturity dates. After a fixed period, the ETFs mature and return a final pay out to investors, in addition to regular interest payments.

Clients from Scalable Capital, a leading investment platform in Europe, will receive 2.6 % interest p.a. on cash balances of up to 100,000 euro from August 3rd, 2023. This is the highest permanent interest rate of any broker currently in the market. The offer applies to both existing and new customers of the PRIME+ broker. The variable interest rate is paid out quarterly via the partner bank (Baader Bank), until further notice, for existing and new cash balances on the cash account.

Scalable Capital, a leading investment platform in Europe, will pay 2.3 percent interest on cash balances to enable investors to benefit from the positive interest rate trend. The offer starts on February 1st and applies to both new and existing clients of PRIME+ across Europe. The price model PRIME+ combines a market leading deposit interest offer with the most affordable and best brokerage service for stocks and ETFs.

Scalable Capital, a leading European digital investment platform, expands to the Netherlands. Scalable Broker and Scalable Crypto provide Dutch retail clients with convenient and cost-effective trading and savings plans in exchange traded funds (ETFs), mutual funds, stocks as well as cryptocurrencies. Regulated by the German financial supervisory authority BaFin, Scalable Capital provides a secure and innovative full-service brokerage offering.

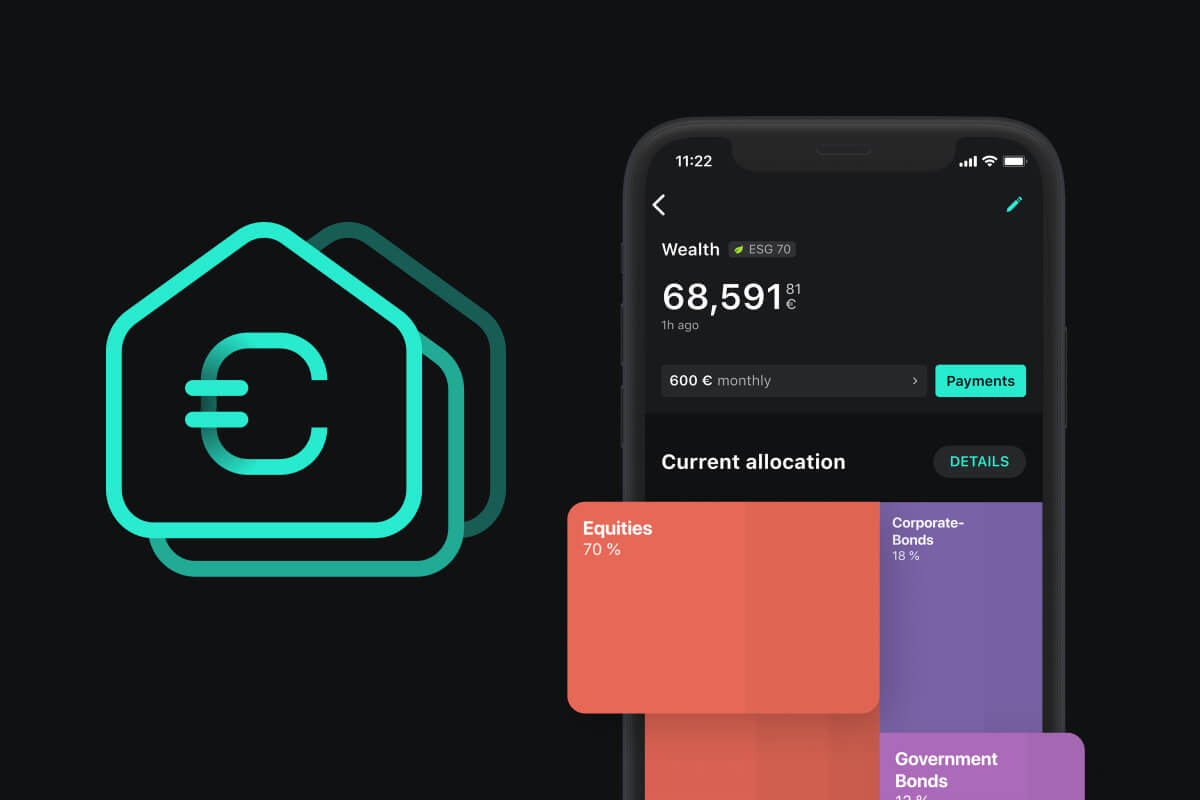

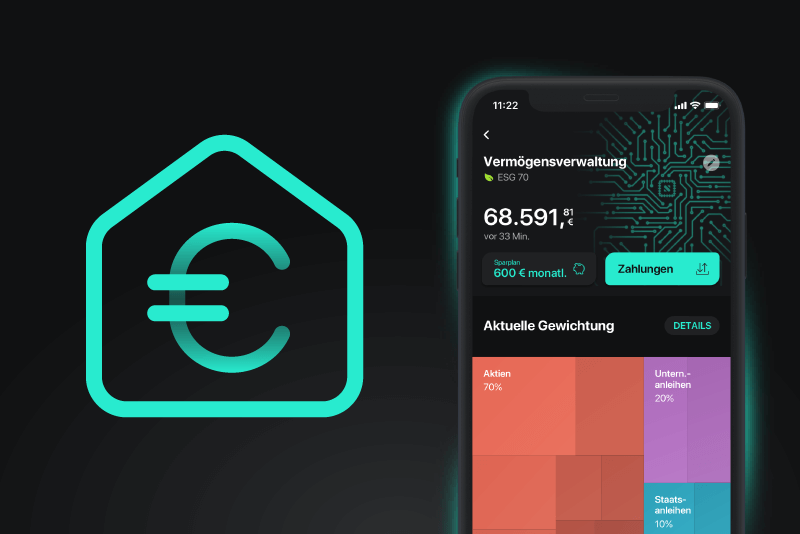

Scalable Capital, the leading digital investment platform in Europe, is launching eight new investment strategies in its digital wealth management service. As of now, clients can choose from eleven different ETF-based investment approaches - including new strategies focusing on climate protection, value-investing and crypto.

Scalable Capital, a leading digital investment platform in Europe, launches its online broker and crypto offering in the Austrian market. With “Scalable Broker” and “Scalable Crypto” the company introduces convenient and cost-effective trading in more than 6,000 stocks, 1,500 exchange traded funds (ETFs), 2,000 mutual funds and 375,000 derivatives. Moreover, Austrian clients can invest in all major cryptocurrencies and set up savings plans on stocks and ETFs without commissions.

Scalable Capital, on its mission to become Europe's leading digital investment platform, expands its investment platform to Italy.

Scalable Capital, a leading fintech company in Europe, introduces Alessandro Saldutti in the role of Country Manager for Italy. Alessandro worked at the US investment bank Goldman Sachs, in their Zurich offices, managing wealth for highly affluent private clients, family offices, foundations and trusts.

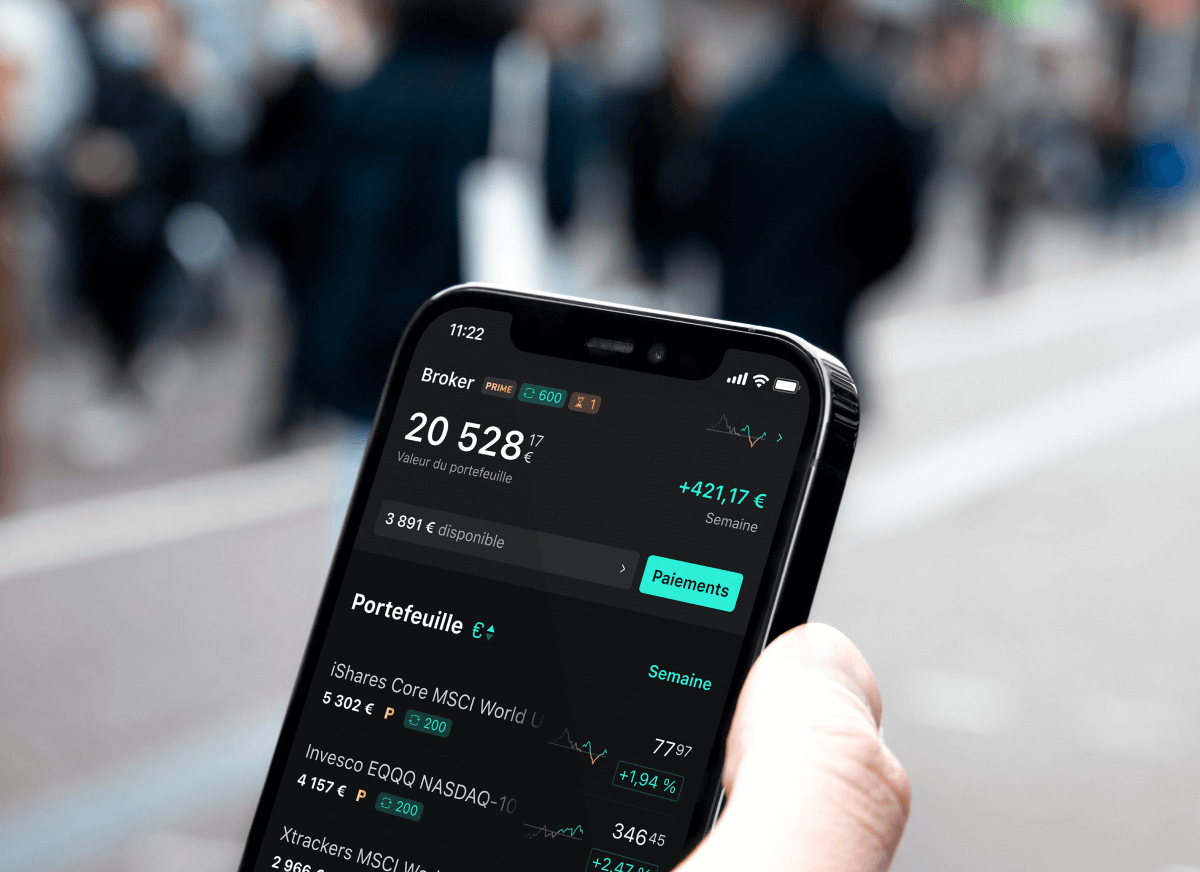

Scalable Capital continues on its path to becoming Europe's leading digital investment platform. As of this week, customers in France and Spain can easily trade stocks, ETFs and cryptocurrencies, all at low cost with the Scalable Broker, as well as set up ETF, crypto and stock savings plans. Italy and Austria will follow in a few weeks.

Scalable Capital, on its mission to become Europe's leading digital investment platform, starts its international expansion in France.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, launches 'Scalable Crypto', a new offering for investing in crypto currencies. The offering merges seamlessly with the existing wealth management and neo-broker offerings. Via intuitive user interfaces for web and mobile, the company now offers easy, affordable and secure access to crypto investments via regulated stock exchanges in Germany. The offer is aimed at all investors who want to take their financial investment into their own hands and diversify a part of their portfolio with digital assets.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, is removing the previously required minimum investment amount of 10,000 Euros in its digital wealth management service. From November 30, 2021, every client with a savings plan will be able to invest money in digital wealth management from as little as 20 Euros per month - the initial payment previously required will no longer apply.

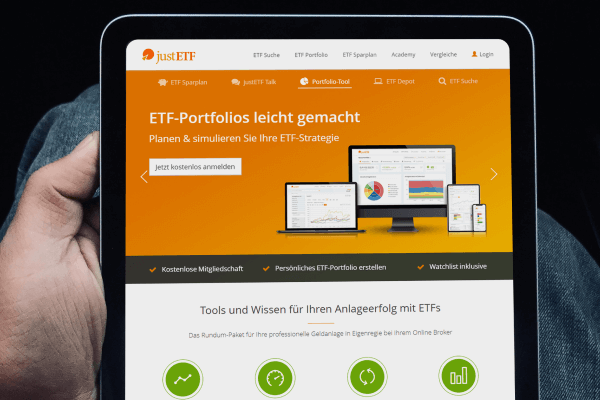

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, expands its information services and acquires justETF GmbH, a special interest portal for exchange-traded index funds (ETFs) and investing. The founders of justETF, Dominique and Petra Riedl from Kirchentellinsfurt, as well as the team remain on board after the acquisition.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, has comprehensively expanded its savings plan offering. Clients can now regularly save towards stocks, ETFs and cryptocurrencies starting at just 1 Euro savings rate – free of order fees. With this offer, the company is taking a big step towards becoming the leading digital investment platform.

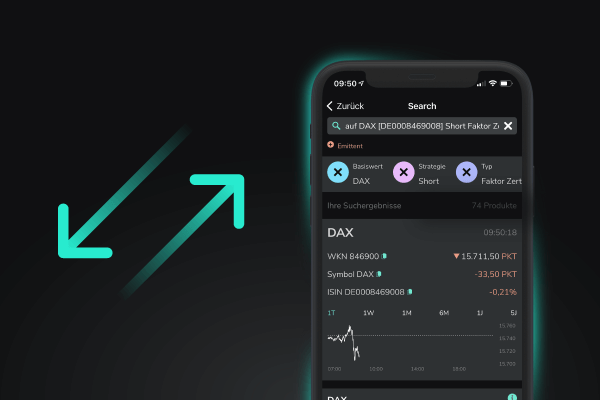

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, is taking the next step on its way to become Europe's leading digital investment platform and is expanding its product portfolio within the broker to include derivatives. Clients are now able to trade certificates, warrants or other leveraged products from the cooperation partners HSBC and HypoVereinsbank onemarkets. Goldman Sachs will join as a third partner soon.

Scalable Capital, a fast growing neo-broker and Europe's largest digital wealth manager, has raised more than $180 million (€150 million) in a Series E funding round led by China’s leading technology company Tencent.

Scalable Capital, neo-broker and Europe's largest digital wealth manager, has appointed Dirk Urmoneit as Chief Strategy Officer, effective June 1, 2021. The capital markets specialist will further accelerate Scalable Capital's growth, particularly in neo-brokerage.

Contact

Ina Froehner

VP Communications & Public Affairs

+49 160 94435932

presse@scalable.capital

Marketingaanvragen

marketing@scalable.capital