Profiteer tijdelijk van: Een TER van 0,00% p.a.1

Scalable Xtrackers ETF

Een nieuwe wereldwijde standaard.

Maak kennis met de "one-of-a-kind" Scalable Xtrackers MSCI All Country World UCITS ETF. De enige ETF met hybrid replication en wereldwijde diversificatie: De kern voor je portfolio.

ISIN: LU2903252349

Beleggen brengt risico's met zich mee. Geen beleggingsadvies.

De enige ETF die je nodig hebt De kernkeuze voor een wereldwijd portfolio |

|

Structurele outperformance Geavanceerde |

|

Hyper-diversificatie 90% wereldwijde |

|

Scalable & Xtrackers Gecombineerde expertise op de kapitaalmarkt |

Scalable MSCI AC World

Xtrackers UCITS ETF

ISIN: LU2903252349 | WKN: DBX1SC

Structurele outperformance | |

Hyper-diversification | |

Goedkoopste wereld-ETF |

1 De reguliere totale kostenratio (TER) van 0,17% p.j. wordt kwijtgescholden tot 11-06-2026. Meer informatie vind je op de Xtrackers productpagina.

Outperformance door innovatie

De eerste ETF ter wereld die het rendement maximaliseert met de geavanceerde innovatie van hybride replicatie.

De baanbrekende hybride replicatie combineert het beste van twee werelden en maakt gebruik van de voordelen van fysieke en synthetische replicatie. Deze benadering is ontworpen om maximale structurele outperformance te genereren via belastingvoordelen en verbeterde toegang tot illiquide markten met structurele voordelen om te profiteren van potentieel rendement.

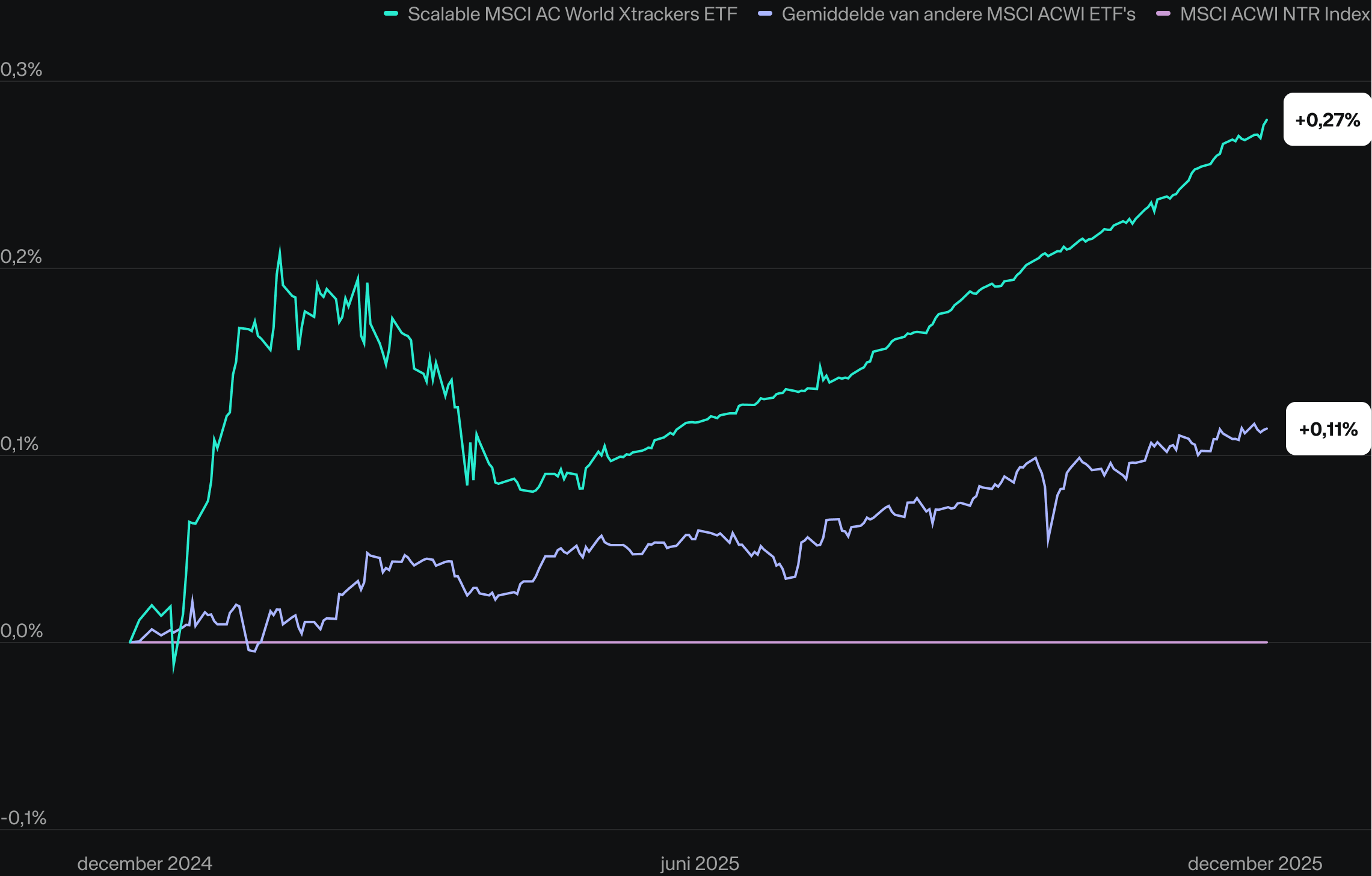

Het eerste jaar heeft het concept bevestigd: de Scalable AC World Xtrackers ETF heeft de verwachte outperformance geleverd ten opzichte van de onderliggende index (MSCI ACWI) en andere All Country World ETF's dankzij de innovatieve hybride replicatiemethode. Bovendien bleek de hyper-diversificatie van de ETF bijzonder gunstig. Door de sterke prestaties van de opkomende markten in het afgelopen jaar presteerde de breder gediversifieerde ACWI-index aanzienlijk beter dan de traditionele MSCI World, die deze cruciale blootstelling aan opkomende markten mist.

- Scalable ETF-prestaties: 7,87% (+0,27 procentpunt outperformance)

- MSCI All Country World (ACWI): 7,60%

- MSCI World: 6,69%

Gerealiseerde relatieve outperformance van 0,27 procentpunt in het eerste jaar

Opmerking: In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor de toekomst.

Gerealiseerd rendement na kosten (inclusief de tijdelijke kostenverlaging van de Scalable ETF, die een positief effect heeft op de weergegeven prestaties) ten opzichte van de MSCI ACWI Net Total Return Index en de MSCI World Net Total Return Index. De grafiek bevat de gelijkgewogen gemiddelde prestaties van de drie grootste MSCI ACWI UCITS ETF's (op basis van fondsvolume en verhandelbaar op XETRA; ISIN's: IE00B6R52259, IE00B44Z5B48, LU1829220216) ten opzichte van de MSCI ACWI Net Total Return Index. Periode van 1 jaar van 20-12-2024 t/m 19-12-2025.

Bron: Bloomberg

De grafiek is genormaliseerd naar de index voor een nauwkeurige vergelijking.

In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor de toekomst. Beleggen brengt risico's met zich mee.

Hybrid replication onthuld

Dit is hoe de Scalable MSCI AC World Xtrackers ETF hybride replicatie gebruikt, afhankelijk van het specifieke type effect, om de structurele outperformance te maximaliseren. De volgende grafiek toont de huidige allocatie van de ETF2.

2 De grafiek is een visualisatie en geeft niet de werkelijke wegingen weer.

Synthetisch

|

Nauwkeurigere tracking van moeilijk bereikbare of illiquide markten |

|

Structurele outperformance dankzij 0% bronbelasting op dividenden van Amerikaanse aandelen en structureel voordeel op Chinese A-aandelen |

|

Hogere liquiditeit voor sommige markten |

Fysiek

|

Hoge transparantie van ETF-componenten |

|

Eenvoud door directe fysieke investering in onderliggende activa |

|

Rechtstreeks bezit van de effecten |

Meer gedetailleerde informatie over hybride replicatie kun je lezen in ons financiële basisprincipes artikel.

Hyper-diversificatie voor je investering

Beleg in de hele wereld met slechts één ETF: Dekt bijna 90% van de wereldwijde belegbare markten in 23 ontwikkelde en 24 opkomende landen. De Scalable MSCI AC World Xtrackers ETF is de eenvoudige alles-in-één oplossing voor wereldwijde diversificatie. Het maakt het samenstellen en herbalanceren van portfolios overbodig.

3 Gegevens per 30/11/2024. De MSCI ACWI All Cap Index fungeert als proxy voor de berekening van de wereldwijde marktdekking en dus als referentiepunt voor de berekening van de marktdekking van elke index. Cijfers zijn afgerond op het volgende even procentpunt.

Meer informatie over de allocatie van de ETF is te vinden in de Essentiële-informatiedocument of in de factsheet.

Laat je rendement niet opslokken door kosten

Met de meest kosteneffectieve All Country World ETF beschikbaar tegen 0,00% p.j. TER tot juni 2026.1 Daarna slechts 0,17% per jaar.

1 De reguliere totale kostenratio (TER) van 0,17% p.j. wordt kwijtgescholden tot 11-06-2026. Meer informatie vind je op de Xtrackers productpagina.

FAQs

Veelgestelde vragen over de Scalable MSCI AC World Xtrackers ETF.

De Scalable MSCI AC World Xtrackers ETF volgt de MSCI ACWI Index.

De MSCI All Country World Index (kortweg MSCI ACWI Index) dekt 47 ontwikkelde en opkomende landen en wordt beschouwd als een van de toonaangevende benchmarks voor een wereldwijde aandelenportefeuille. Meer informatie over de ETF is te vinden op de productdetailpagina van Xtrackers.

Om de beste wereldwijde aandelen-ETF te creëren, is Scalable Capital een samenwerking aangegaan met Xtrackers by DWS, een langdurige partner en gewaardeerde ETF-uitgever gevestigd in Duitsland met vele jaren ervaring in de ETF-industrie. Xtrackers by DWS biedt ongeveer 170 ETF's aan in verschillende activaklassen onder de merknaam Xtrackers, met meer dan USD 120 miljard aan vermogen onder beheer. Xtrackers by DWS zorgt ervoor dat de activa van de ETF veilig zijn en goed beheerd worden als een UCITS ETF, inclusief naleving van de regelgeving, bewaring van activa, transparantie, meerlaagse beveiligingsmaatregelen en risicobeheer.

Scalable Capital en Xtrackers hebben wereldwijd de eerste ETF met hybrid replication gecreëerd.

Tot nu toe moesten beleggers beslissen of de ETF zijn blootstelling fysiek of synthetisch moest repliceren. Hoewel de meeste ETF's in Europa gebruik maken van fysieke replicatie, kan het voordelig zijn (vooral voor Amerikaanse aandelen en China A-aandelen) om de posities synthetisch te repliceren. Een synthetic replication kan in sommige gevallen een betrouwbare en consistente structurele outperformance opleveren.

Met de nieuwe ETF's kunnen Scalable Capital en Xtrackers by DWS hun expertise combineren en onafhankelijk en flexibel in tijd de beste replicatiemethode kiezen voor elk land en elke regio. Met de nieuwe ETF kunnen beleggers profiteren van maximale efficiëntie en structurele outperformance met behoud van alle voordelen van traditionele ETF's (bijv. kostenefficiëntie, eenvoudige verhandelbaarheid, automatische herbalancering binnen de ETF, belastingefficiëntie).

De Scalable MSCI AC World Xtrackers ETF is gecreëerd op basis van het idee dat niet alleen blootstelling, maar ook een zo efficiënt mogelijke replicatie belangrijke criteria zijn bij het selecteren van ETF's.

Beleggers moeten zich daarom niet alleen afvragen in welke beleggingscategorieën ze moeten beleggen. Een even belangrijke vraag is de efficiënte replicatie van deze activaklassen binnen de ETF. Scalable Capital ontdekte dat de meeste ETF's gebruik maken van fysieke replicatie, hoewel synthetische replicatie voor sommige regio's aanzienlijke prestatievoordelen kan opleveren, met name voor Amerikaanse en Chinese aandelen. Tegelijkertijd willen veel particuliere beleggers hun portfolio zo eenvoudig mogelijk houden en breed gediversifieerd beleggen met één of slechts enkele ETF's.

Met dit idee in het achterhoofd is Scalable een samenwerking aangegaan met Xtrackers by DWS. De Scalable MSCI AC World Xtrackers ETF is het resultaat van de uitgebreide kapitaalmarktexpertise van Scalable Capital in Wealth Management in combinatie met de decennialange ervaring van Xtrackers in het beheer van synthetische ETF's.

Synthetische exchange-traded funds bestaan al meer dan 20 jaar en zijn ook zo ontworpen: Bij synthetische replicatie sluit de ETF-aanbieder een overeenkomst in de vorm van een swap met een bank (of meerdere banken) waarin de exacte prestatie van de gewenste index wordt gegarandeerd en afgedekt. Een synthetische ETF bezit dus doorgaans niet de onderliggende effecten. Dit onderpand wordt beheerd door de emittenten en transparant gepubliceerd op hun website.

De ETF geeft over het algemeen de voorkeur aan fysieke replicatie, maar kan synthetische replicatie gebruiken als dit structurele of andere voordelen biedt (bijv. lagere tracking error). De keuze tussen fysieke of synthetische replicatie is flexibel in de tijd om de meest efficiënte replicatie voor elke blootstelling mogelijk te maken zonder de fiscaal onhandige noodzaak van het kopen en verkopen van ETF's op het niveau van de individuele belegger.

De ETF is accumulerend. Het herbelegt de dividenden die door de onderliggende holdings worden uitgekeerd in het fonds.

ETF's vallen onder bijzondere activa en zijn daarom onbeperkt gevrijwaard van insolventie, waardoor ze zeer geschikt zijn voor grotere investeringsbedragen. We werken samen met Xtrackers by DWS, een van de toonaangevende indexuitgevers in Europa met een beheerd vermogen van meer dan 120 miljard USD. De ETF is onderworpen aan de Europese wettelijke normen voor beleggersbescherming (in overeenstemming met UCITS).

De ETF is verhandelbaar op Xetra, gettex, European Investor Exchange en veel andere Europese beurzen. Je kunt het vinden met de ISIN: LU2903252349 of de WKN: DBX1SC. Als het niet beschikbaar is bij de broker van je keuze, kun je contact met ze opnemen met het verzoek om het toe te voegen voor verhandeling.

De reguliere totale kostenratio (TER) van 0,17% p.j. wordt kwijtgescholden tot 11-06-2026. Meer informatie vind je op de Xtrackers productpagina. Dit betekent dat de World ETF nog steeds een van de goedkoopste ETF's op de MSCI ACWI Index is.

Nee, de verlaagde vergoeding geldt voor ten minste 12 maanden na de lancering van de wereldwijde ETF en is niet gebaseerd op de houdperiode van de klant. Daarna is de totale kostenratio 0,17%. Dit betekent dat de World ETF nog steeds een van de goedkoopste ETF's op de MSCI ACWI Index is.

De belastingimpact van de vestigingsplaats van een fonds is een belangrijke overweging voor beleggers, vooral als het gaat om Amerikaanse aandelen. Bij synthetische replicatie zijn er bepaalde bronbelastingvoordelen in vergelijking met fysieke replicatie.

Volgens de Amerikaanse wetgeving heeft de vestigingsplaats van het fonds (zoals Ierland of Luxemburg) geen invloed op deze voordelen wanneer synthetische replicatie wordt toegepast. Dit betekent dat het voordeel van de bronbelasting consistent blijft voor alle vestigingslanden van de fondsen ten opzichte van de MSCI ACWI Index, en 30% bedraagt.

|

Sluit aan bij 1+ miljoen |